08Jan2026

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam is one of the world’s leading textile and garment exporters, with total export turnover of the sector reaching more than USD 41.4 billion in 2024, up nearly 10% compared to 2023[1]. Behind the success of garment products is the fabric market, which serves as the critical foundation for garment production, providing the essential input material.

Domestic fabric production situation in Vietnam

In 2024, Vietnam’s textile sector has over 7,000 enterprises, but there is 18% produce fabric. Vietnam is still mainly concentrated in low value-added segments such as cut–make–trim (CMT) production and original equipment manufacturing (OEM), where enterprises work largely on a subcontracting basis for foreign brands. In contrast, the higher value stages of original brand manufacturing (OBM) and original design manufacturing remain underdeveloped, with only a limited number of Vietnamese companies investing in building their own brands or design capabilities.

Vietnam currently produces a variety of fabrics: from traditional woven and knitted fabrics (for clothing) to new product lines such as eco-fabrics from natural fibers (bamboo fiber, hemp fiber, lotus silk fabric, etc.) and specialized technical fabrics. In the period of 2021-2025, Vietnam Textile and Garment Group, a pioneer in the fabric and garment industry, announced the quantity of fabric produced, including 170 million square meters of woven fabric, 35,000 tons of knitted fabric, and 10,000 tons of home textiles[2].

In 2024, Vietnam generated about 2.3 billion meters of fabric per year, but it only met just 25% of total demand. The shortage of domestic fabric supply stems from the fact that the fabric market is still not truly attractive to local manufacturers, due to several major constraints[3]:

– Very high initial investment costs, especially for wastewater treatment systems that meet environmental standards. This is a major challenge for around 80% of Vietnamese textile and garment enterprises, which are small and medium-sized and therefore constrained in terms of financial capacity and management.

– Limitations and Shortage of skilled labor and in fabric design and printing, which makes Vietnamese fabrics insufficiently competitive in the mid- to high-end segments.

– Failure to achieve economies of scale: resulting in fabric produced in Viet Nam being significantly more expensive than in major fabric-producing countries in the region and globally, such as China and India.

However, Vietnam also has some advantages in the field of fabric production, such as[4]

– Large domestic fabric consumption market: Vietnam’s sizeable textile and garment industry requires a large volume of auxiliary materials, especially fabric. The Government’s strategy for 2026–2030 targets a localization rate of 56–60%, showing strong support for developing domestic fabric and auxiliary material production.

– Strengths in certain types of natural-origin fabrics: Vietnamese enterprises have successfully produced fabrics from natural materials such as pineapple leaves, bamboo, and hemp to meet the green and sustainable sourcing requirements of major brands like Nike and Adidas. Lotus silk, in particular, is a rare handmade fabric with a very high cost, used for premium products such as lotus silk scarves.

– Abundant and skilled labor force: Vietnam has a relatively large labor force in the textile and garment sector. Vietnamese workers are known for their fine sewing skills, helping ensure more consistent product quality compared with some other countries in the region, such as Indonesia, Bangladesh, and India.

Meritorious artisan performs the process of taking lotus silk

Source: TuoitreThudo

Import and export situation of the fabric sector in Vietnam

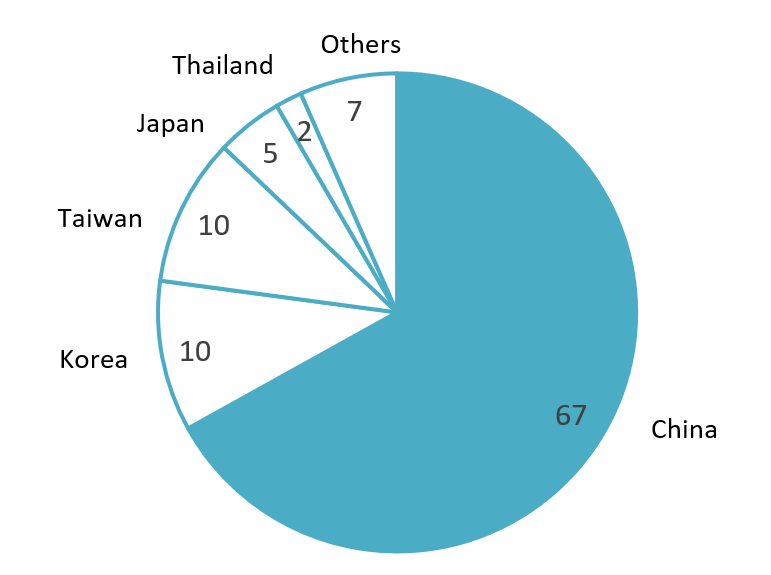

In terms of fabric import, the import value in 2024 reached USD 14.9 billion, up 15% compared with 2023. Specifically, fabric imports from China account for nearly 67% of total fabric imports, followed by South Korea (10%) and Taiwan (10%). Imports from Japan and Thailand account for about 5% and 2% respectively, both decreasing compared with 2023.

Some major fabric import markets of Vietnam in 2024

100% = 14.9 billion USD

Source: Import-Export Report 2024

On the other hand, Vietnam’s fabric exports remain modest, mainly consisting of output sold by a limited number of domestic weaving companies or re-exports under processing contracts. Fabric exports in 2024 are estimated at only about USD 2.7 billion; although this is a 12% increase compared with 2023, it is still very small relative to the volume of imported fabric, indicating that Vietnam largely continues to play the role of a garment “workshop” dependent on imported fabrics.

Key market trends

In recent years, several new trends have emerged in Vietnam’s fabric market, including:

– Shift in supply chains and rising foreign investment: As global buyers seek to diversify their supply chains away from China, Vietnam has become an attractive destination for fabric manufacturers aiming to leverage competitive costs, an abundant labour force, and tariff preferences under free trade agreements. Notably, in 2024, Toray Group (Japan) inaugurated the Top Textiles plant in Nam Dinh – a high-tech dyeing and weaving project with an investment capital of USD 203 million. Phase 1 of the plant has a capacity four times larger than the province’s total previous dyeing and weaving capacity[5].

– Move towards sustainable, high-tech products: Many enterprises are focusing on developing specialized fabric lines and adopting green production standards. New dyeing and weaving plants are investing in water-saving technologies, chemical recycling in the dyeing process, and modern wastewater and exhaust-gas treatment systems that meet Class A environmental standards (the highest level in Vietnam)[6]. In parallel, the industry is experimenting with and using new sustainable fiber materials such as hemp and bamboo to meet the growing global demand for sustainable fashion[7]. However, the production quantity is still small and medium. An Phuoc hemp factory produces 1,700 tons of hemp fiber and 1,400 tons of hemp-cotton blended fiber per year[8]

– Rising requirements for traceability and sustainability certifications: Global brands increasingly require clear traceability for fibers and fabrics, along with certification systems such as OEKO-TEX, GRS, BCI, and ISO related to environmental performance and chemical safety. This trend forces fabric manufacturers in Vietnam to digitalize supply-chain management, implement quality-management systems, record data at the lot level for yarns and fabrics, and invest in obtaining international certifications. Companies that can meet these traceability and certification requirements will gain a significant advantage in attracting orders, particularly from the Japanese and EU markets[9].

Highly durable fiber is produced from hemp with advanced, modern technology

Source: VnEconomy

Key fabric manufacturers in Vietnam market

Vietnam’s fabric manufacturing is being led by a number of long-established, representative enterprises. In addition, several foreign manufacturers have also entered the Vietnamese market in recent years.

| No | Company name | Country | Headquarter | Establishment year | Short description | Website |

| 1 | Vietnam Textile and Garment Group (Vinatex) | Vietnam | Hanoi | 1995 | Owns 4 fabric factories (woven: ~170 million m²/year; knitted: ~25,000 tons/year) and 12 yarn factories (1 million spindles/year) in Hanoi, Nam Dinh, Thua Thien Hue and Ho Chi Minh City | https://vinatex.com.vn/ |

| 2 | Phong Phu Joint Stock Corporation | Vietnam | Ho Chi Minh | 1964 | 3 integrated plants (yarn–weaving–dyeing–sewing–towels), capacity ~23 million meters of fabric/year, producing yarn, denim, towels, household fabrics and export fashion items | http://phongphucorp.com |

| 3 | Thanh Cong Joint Stock Company (TCM) | Vietnam | Ho Chi Minh | 1976 | Capacity of ~10 million meters of woven fabric/year and ~8,400 tons of knitted fabric/year, exporting woven/knitted fabrics and garments to the US, Japan, Korea, EU, etc | https://www.thanhcong.com.vn/ |

| 4 | Viet Thang Corporation | Vietnam | Ho Chi Minh | 1962 | Capacity of ~40 million meters of fabric/year, producing yarn, greige fabric, finished fabric and some garments for domestic and export markets. | https://vietthang.com.vn/ |

| 5 | Dong Xuan Knitting Company Limited (Doximex) | Vietnam | Hanoi | 1959 | State-owned enterprise, with a spinning–knitting–finishing–sewing complex in Hung Yen, capacity ~15–20 million products/year, supplying knitted fabrics and garments for domestic customers and especially Japan. | https://doximex.vn/ |

| 6 | Hualon Corporation Vietnam | Malaysia & Taiwan | Dong Nai | 1993 | Running a large spinning–weaving–dyeing–finishing complex in Dong Nai, supplying synthetic knitted and greige fabrics for export and domestic clients. | http://www.hualonvn.com.vn |

| 7 | Texhong Textile Group | Hongkong | Binh Duong | 2006 | Operating 5 fiber plants in Dong Nai and additional fiber/textile plants in Quang Ninh, with capacity of about 82,500 tons of fabric/year. | https://www.texhong-vietnam.com/ |

| 8 | Tuong Long Textile Company Limited | Vietnam | Binh Duong | 2000 | Having a weaving–dyeing–finishing plant in Binh Duong equipped with modern European and Japanese machinery, capacity ~15 million meters of denim/year. | https://tuonglong.com/en/ |

| 9 | Bao Minh Textile Joint Stock Company | Vietnam | Nam Dinh | 2018 | Investing in a closed-loop spinning–weaving–dyeing factory in Nam Dinh, focusing on high-quality shirting and yarn-dyed fabrics for export and domestic markets. | https://www.baominhtextile.com/ |

| 10 | Top Textiles | Japan | Ho Chi Minh | 2024 | High-tech textile-dyeing plant of Japan’s Toray Group and Pacific Textiles in Nam Dinh, total investment over USD 203 million; Phase 1 completed with capacity of 96 million meters of fabric/year. | https://www.toray.com/ |

Source: B&Company’s Synthesis

The landscape of Vietnam’s fabric industry is being shaped by a combination of long-established domestic enterprises and large-scale FDI players from China/Hong Kong, Malaysia/Taiwan and Japan. Vietnamese companies are mainly concentrated in traditional textile and garment clusters such as Ha Noi, Nam Dinh, Ho Chi Minh City and Binh Duong. Alongside these major long-standing textile and garment firms, in recent years, several foreign and domestic manufacturers such as Bao Minh and Top Textiles have entered and expanded their investments in fabric production in Vietnam. These plants are typically newly built on a large scale, equipped with modern, highly automated weaving–dyeing–finishing technologies and oriented towards sustainable fabric production.

Assessment of Vietnam’s Fabric Sourcing Potential

Vietnam has strong potential to become a key regional fabric sourcing hub, leveraging its top-three global garment export position and large, stable fabric demand. A ready domestic market, good connectivity to global supply chains, and next-generation FTAs (CPTPP, EVFTA, RCEP, etc.) all encourage the use of Vietnam-made fabric. The Government’s target of a 56–60% localization rate for 2026–2030, together with competitive labor costs and a stable investment environment, is also attracting significant FDI, including from Japanese investors with advanced textile technologies, creating ample cooperation opportunities.

However, the textile–dyeing segment remains a “bottleneck”, especially in environmental treatment, which demands large capital, advanced technology, and long payback periods, leading to project delays or. Domestic fabric varieties are still limited, with shortages of functional and high-end fashion fabrics, so part of the demand is met by imports. The industry also faces intense competition from major producers such as China, India, and Bangladesh, forcing Vietnamese firms to continuously upgrade technology, improve quality, and move into higher value-added segments.

For firms interested in sourcing fabric from Viet Nam, the following recommendations should be considered:

– First, focus on fabric categories where Viet Nam has clear strengths, such as basic woven/knit fabrics, denim, shirting fabrics and yarn-dyed fabrics. These are segments with relatively stable production capacity and lower sourcing risk. Moreover, Vietnam also has an advantage in some new natural fabrics such as hemp-fiber fabric, bamboo-fiber fabric, lotus silk and mulberry silk.

– Second, build long-term partnerships with a number of key mills (such as Bao Minh, Vinatex member companies, Top Textiles, etc.), moving beyond one-off transactions towards a true “sourcing partner” model: sharing medium- to long-term order plans, co-developing fabric styles, aligning quality standards and control procedures. This will give suppliers the confidence to invest in technology and expand capacity dedicated to your orders.

– Third, prioritise suppliers with strong environmental compliance capabilities and recognised sustainability certifications (OEKO-TEX, GRS, ISO, etc.), while proactively leveraging FTAs (CPTPP, EVFTA, RCEP) to design supply chains that meet rules of origin. This not only optimises tariffs on garment products but also strengthens your “green sourcing” image with end customers.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Viet Nam Import–Export Report 2024 <Access>

[2] Vinatex.30 years of journey: Vinatex – from strategic seed to pillar of Vietnam’s Textile and Garment industry <Access>

[3] Textile Sector Update – Upstream expansion to support higher returns <Access>

[4] VietnamPlus. Vietnam’s textile and garment industry faces intertwined difficulties and opportunities <Access>

[5] Nam Dinh officially puts a high-tech weaving and dyeing plant into operation <Access>

[6] Greening the textile and garment industry to escape the outsourcing trap <Access>

[7] Hemp – What is hemp fabric? A sustainable material that can be easily developed in Viet Nam <Access>

[8] Organic textiles produced in Vietnam, 23/12/2024. <Access>

[9] What is the textile certification system? What does it mean? <Access>