01Oct2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The global garment industry is under increasing pressure due to its environmental impact, contributing about 10% of global carbon emissions.[1] The use of chemicals and pesticides in traditional cotton farming has led to soil and water pollution, prompting manufacturers to seek more sustainable materials.[2] With the global push for sustainable development and a circular economy, the green transition has become essential to staying competitive in the global supply chain.[3] Import markets like the EU, US, and Japan are tightening environmental standards, requiring transparency, carbon emission reductions, clean energy use, and increased recycling.[4] In Vietnam, compliance with these green regulations has become a necessity, presenting an opportunity for businesses to invest in sustainable technologies and processes.

Overview of the Vietnam textile and garment industry

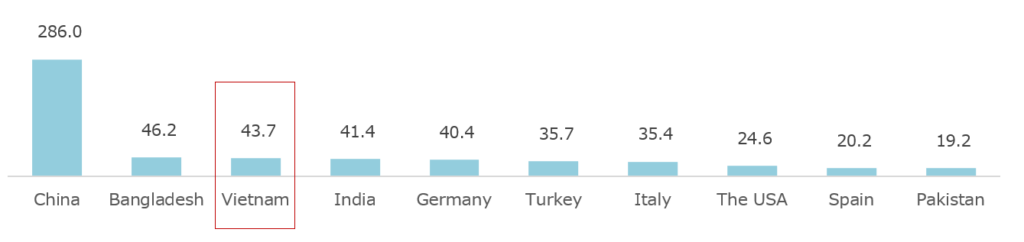

Vietnam has always been among the top countries in the world for textile and garment exports. In 2024, the export value of this product reached nearly 44 billion USD, second only to China and Bangladesh, and has consistently maintained its top 3 position in recent years.[5]

10 countries with the largest textile and garment exports in the world in 2024

(Unit: billion USD)

Source: Kirin Capital, Textile and Garment Industry Outlook Report 2025

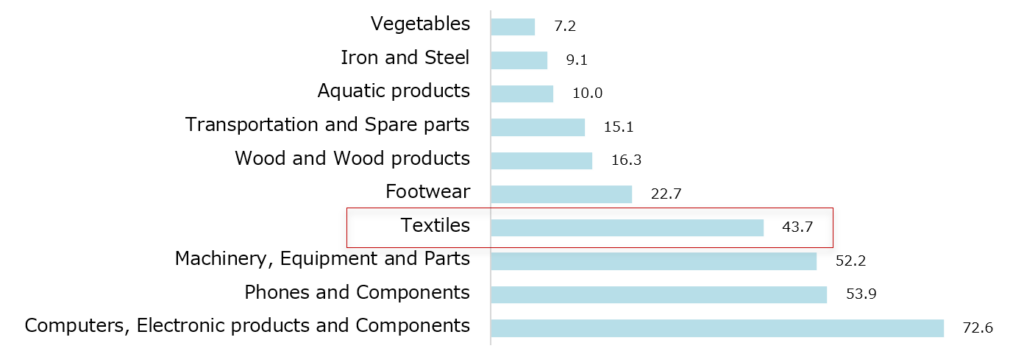

Textiles, yarns, and various types of fabrics are among the key export products in recent years of Vietnam, ranking just behind products such as computers and components, phones and components, machinery and spare parts… According to statistics from the General Statistics Office (GSO) and the Vietnam Textile and Apparel Association (Vitas), as of 2023, there are about 7,000 textile and garment enterprises nationwide. Among them, 80% are small and medium-sized enterprises, and 40% are FDI enterprises. The industry employs 3 million workers, with 70% of the industry’s capacity dedicated to production. The total number of Vietnamese textile and garment enterprises from 2011 to 2023 has tended to increase, thereby contributing significantly to keeping the export turnover of this product always among the top key export products of Vietnam.[6]

10 groups of export product categories with the largest value in Vietnam in 2024

(Unit: billion USD)

Source: General Department of Customs, B&Company’s synthesis

In 2024, the export value reached 43.7 billion USD, marking a 31.2% increase from 2023. Of this, FDI enterprises contributed over 25 billion USD, representing approximately 57% of Vietnam’s total textile and garment exports. Furthermore, by the end of January 2025, the export value for textile and garment products stood at 3.5 billion USD, matching the figure from January 2024.[7]

Vietnam’s capacity to supply environmentally friendly materials

The eco-friendly apparel market is witnessing a rise in awareness and adoption of natural and sustainable fibers. The prominent materials that are gaining traction include lyocell, wool, linen, hemp, silk, and organic cotton.[8]

Organic cotton

Source: Vietnam Textile and Apparel Association

In the long term, Vietnam is also researching the potential of Bio-based Materials, such as bioplastics produced from starch, sugar, or bio-ethylene through fermentation or mechanical processes.[9] This is a strategic direction to reduce dependence on synthetic fibers derived from petroleum, which are a major threat to the environment due to their non-biodegradability, especially polyester.

Besides, developing the supply of recycled input materials is one of the biggest investment opportunities and also the most serious bottleneck of Vietnam’s textile and garment industry today. With the growth rate of the industry, it is estimated that Vietnam has a potential amount of 395-600 thousand tons (KT) of recyclable textile waste per year by 2030.[10] This waste source is diverse, including old clothes from households, scraps, leftover fabrics, defective products from factories, and inventory from fashion stores.[11]

This 395-600 KT of domestic textile waste represents a huge untapped secondary resource, especially important as international markets continue to demand “more recycling”.[12] Investing in professional automated sorting systems, which can use imaging or chemical technology, will help to free up the supply of high-value raw materials, reducing dependence on raw material imports or low-quality recyclables.

Characteristics, supply capacity, and development potential of sustainable garment materials in Vietnam

| Type of material | Organic Cotton | Recycled Fibers | Bio-based |

| Origin/Production process | Non-GMO seeds, no use of chemicals (pesticides, fertilizers) | Textile waste, PET plastic (through Mechanical or Chemical treatment) | Regenerated cellulose (wood) or bioplastic production from starch, sugar (through fermentation process) |

| Main environmental advantages | Protect soil, reduce water pollution, and negative impacts on farmers’ health | Promote Circular Economy, convert 395-600KT waste into resources | High biodegradability, closed production process, environmentally friendly |

| Supply capacity in Vietnam | Already applied, but need to expand cultivation area and supply chain certified by GOTS | Abundant waste sources, but primary sorting and chemical recycling capacity are still weak | Mainly imported, researching the potential for production from domestic agricultural raw materials |

| Main players | Greenyarn| W.ELL Fabric| Thai Son Co., Ltd| Ecosilky| Thygesen Textile Vietnam| Doan Ket Co., Ltd | W.ELL Fabric| Thanh Cong Group| Viet Thang Company| | W.ELL Fabric| Ecosoi| Ecofa| Greenyarn| Ecosilky| |

| Investment recommendation | Invest in organic farming standards, the GOTS certification system, and integrate the fiber/fabric supply chain. | Invest in building automatic sorting infrastructure, and develop chemical “fiber-to-fiber” technology. | Invest in Research and Development (R&D), transfer technology for producing new generation biofibers. |

Source: B&Company compilation

Case Study: Greenyarn – Pioneer of sustainable fabric fibers in Vietnam[13]

Greenyarn, a subsidiary of Bao Lan Textile Company Limited, was established with the goal of becoming the first company in Vietnam specializing in providing sustainable textile fibers. With a business philosophy that takes harmony and balance between humans and nature as a guiding principle, Greenyarn considers sustainable development not only as the future but also as an important competitive factor in the textile industry.

Greenyarn has successfully created a competitive advantage through green product diversification and specialization.

| Field | Strategy | Details |

| Core product | Developing biomaterials and recycled materials | Providing 5 main product lines: Cellulose (Bamboo, Tencel, Modal), Organic (Organic Cotton), Recycle (from coffee grounds, recycled plastic), Fancy and Special (Bamboo Charcoal, Supima) |

| Added value | Outstanding features | Products are researched to have properties such as antibacterial, anti-UV, breathable, and to meet high-end market demands. |

| R&D and Innovation | Technology pioneering | Actively researching new materials of agricultural origin (e.g., researching pineapple fiber, banana fiber), helping Vietnam join the world eco-textile map. |

| Quality | Guaranteed to International Standards | Achieved prestigious certifications such as GOTS, GRS, and OEK-TEX 100, providing transparency and traceability to customers. |

Greenyarn has emerged as the first sustainable yarn supplier in Vietnam, building a solid foundation of trust and expanding its market to countries such as China, Europe, Australia, and the US. The company not only helps Vietnamese textile and garment enterprises easily access green raw materials but also enhances the competitiveness of its products in the export market, meeting the strict criteria of Free Trade Agreements (FTAs). At the same time, Greenyarn contributes to environmental protection by reducing waste, promoting organic cotton cultivation, and using recycled materials. The company also raises awareness of consumer health and safety with safe, non-toxic yarn products.

Government’s support and financial incentive framework

Government support plays a key role in reducing capital cost barriers for green technology projects.

Supporting Industry Incentives: Projects about producing industrially supported products, including raw materials for the textile and garment industry (fiber, fabric), can enjoy tax incentives according to Decree No. 57/2021/ND-CP. Enterprises need to submit dossiers and receive confirmation of incentives from the Ministry of Industry and Trade to enjoy these policies.[14]

Green Capital Incentives: Capital is the biggest barrier to investing in modern technology. To solve this issue, the Vietnam Environment Protection Fund provides large capital support (over 3,000 billion VND) for projects related to recycling, collection, and treatment of waste and green energy. Especially, the maximum loan term is up to 10 years with extremely preferential interest rates, only 2.6%/year.[15]

The government’s provision of low-interest-rate capital and tax incentives for support industries significantly reduces capital expenditure (CAPEX) for investors. This enables high-tech projects such as chemical recycling or waterless dyeing to become more financially feasible, while reshaping business models, allowing Vietnamese enterprises to compete with technology and sustainability, instead of just competing on labor costs.

Conclusion

The Vietnamese textile and garment industry remains a key export sector, ranking among the top three globally, and is vital to national trade growth. Alongside its success, the industry faces the need to transition towards sustainability by adopting eco-friendly materials and green technologies. The government offers strong support through tax incentives and low-interest green capital, creating a favorable environment for businesses to invest in modern technology and boost competitiveness.

For foreign investors, opportunities abound in the production of bio-based and recycled fibers, such as cellulose fibers (Modal, Tencel), and fibers from new materials like pineapple, banana, and bamboo, as well as recycled polyester, cotton, and nylon. There is also potential in green dyeing technologies, including waterless dyeing and wastewater treatment processes that reduce energy and water use. Investment in green infrastructure, such as eco-friendly textile parks, and supporting services like certification labs (GOTS, GRS) are also key opportunities. In short, Vietnam’s sustainable textile materials market is entering a golden period for FDI, offering investors both cost advantages and the opportunity to be part of a rapidly evolving industry.

[1] Skhcn.daklak.gov.vn, Closed-loop recycling of textile waste: Breakthrough from chemical sorting technology (https://skhcn.daklak.gov.vn/tai-che-khep-kin-phe-thai-det-may-buoc-dot-pha-tu-cong-nghe-phan-loai-hoa-chat-8325.html)

[2] Haitrieu.com, Top 7 Types of Environmentally Friendly Fabrics – Green Materials, Sustainable (https://haitrieu.com/blogs/loai-vai-than-thien-voi-moi-truong/)

[3] Tapchicongthuong.vn, What force drives the “greening” of the supply chain of textile and garment, leather, and footwear? ( https://tapchicongthuong.vn/dong-luc-nao-thuc-day–xanh-hoa–chuoi-cung-ung-det-may–da-giay-129048.htm )

[4] Khcnhungyen.gov.vn, GOTS and GRS Standards: Key Tools to Promote the Textile Industry’s Green Transformation (http://khcnhungyen.gov.vn/tin-tuc/tieu-chuan-gots-va-grs-cong-cu-then-chot-thuc-day-nganh-det-may-chuyen-doi-xanh-3516 )

[5] Kirin Capital, Textile and Garment Industry Outlook Report 2025

[6] Kirin Capital, Textile and Garment Industry Outlook Report 2025

[7] Kirin Capital, Textile and Garment Industry Outlook Report 2025

[8] Haitrieu.com, Top 7 Types of Environmentally Friendly Fabrics – Green Materials, Sustainable (https://haitrieu.com/blogs/loai-vai-than-thien-voi-moi-truong/)

[9] Pvn.vn, Bioplastic and Implementation possibilities in Vietnam (https://pvn.vn/DataStore/Documents/2020/TCDK/T4/Le%20Duong%20Hai%20p.32-39.pdf )

[10] Ungphosuco.vn, Recycling waste from the textile industry in Vietnam (https://ungphosuco.vn/tai-che-chat-thai-cua-nganh-det-may-o-viet-nam/ )

[11] Bactham.net, Recycled textile waste treatment technology: Green solution for sustainable fashion industry (https://bactham.net/cong-nghe-xu-ly-chat-thai-det-may-tai-che.html )

[12] Ungphosuco.vn, Recycling waste from the textile industry in Vietnam (https://ungphosuco.vn/tai-che-chat-thai-cua-nganh-det-may-o-viet-nam/ )

[13] B&Company ‘s compilation, https://greenyarn.vn/

[14] Taxservices.com.vn, Tax incentives for industrial products supporting the textile and garment industry (https://taxservices.com.vn/blogtax/chu-de-hap-dan/uu-dai-thue-cong-nghiep-ho-tro-nganh-det-may.101.html)

[15] Thanhnien.vn, Recyclingplastic textile, garment…will bethe future of theeconomy – Thanh Niên Newspaper (https://thanhnien.vn/tai-che-nhua-det-may-se-la-tuong-lai-cua-nen-kinh-te-185240809184614714.htm)

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |