20Jan2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The pumps market in Vietnam is a growing sector driven by the country’s rapid industrialization, urbanization, and increasing demand for efficient water and wastewater management. As key sectors like oil and gas, manufacturing, and agriculture expand, the need for reliable, energy-efficient pumps continues to grow. With a focus on innovation and sustainability, the market offers immense potential for foreign investors.

Overview of Pumps Market in Vietnam

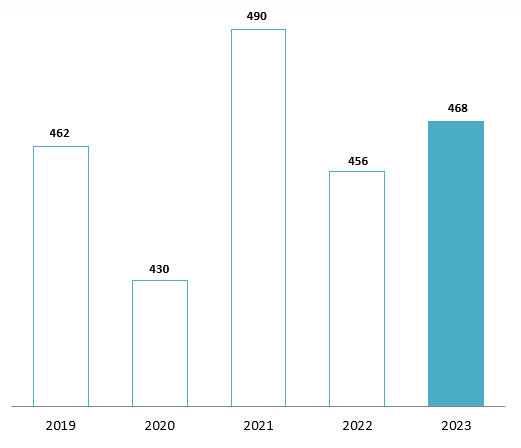

The value of imported pumps in Vietnam has grown by 5%/year in the period 2013-2023 and reached 468 million USD in 2023. Centrifugal pumps accounted for the largest proportion of over 40%, followed by fuel pumps and positive displacement pumps with 11%[1].

Import value of pumps in Vietnam from 2013 – 2023

Unit: Million USD

Source: International Trade Center

Vietnam urbanization rate has reached nearly 40% in 2023[2] and a 6% increase in industrial production compared to 2022[3]. Rising urbanization and industrialization have created heightened demand for efficient pumping solutions, particularly in water management, where the need for reliable systems is supreme. Vietnam’s thriving agriculture sector, which requires advanced irrigation solutions, and the expanding oil and gas industry further amplify the demand for high-performance, energy-efficient pumps.

Notable Brands in the Pump Market

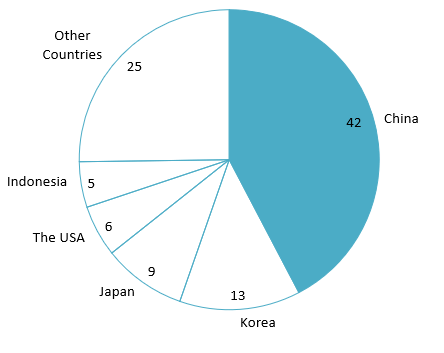

By 2023, most of the pumps are imported from China, in which accounted for 42% of Vietnam total imported value. Korea came second with 13% and Japan with 9%. While Japan, The USA and Italy are the most common brands in Vietnam, China and Korea came out on top as the highest import value since most of the manufacturing factory from different brands are placed in those countries.

Import value of pumps in Vietnam by country in 2023

Unit: 100% = 468 million USD

Source: International Trade Center

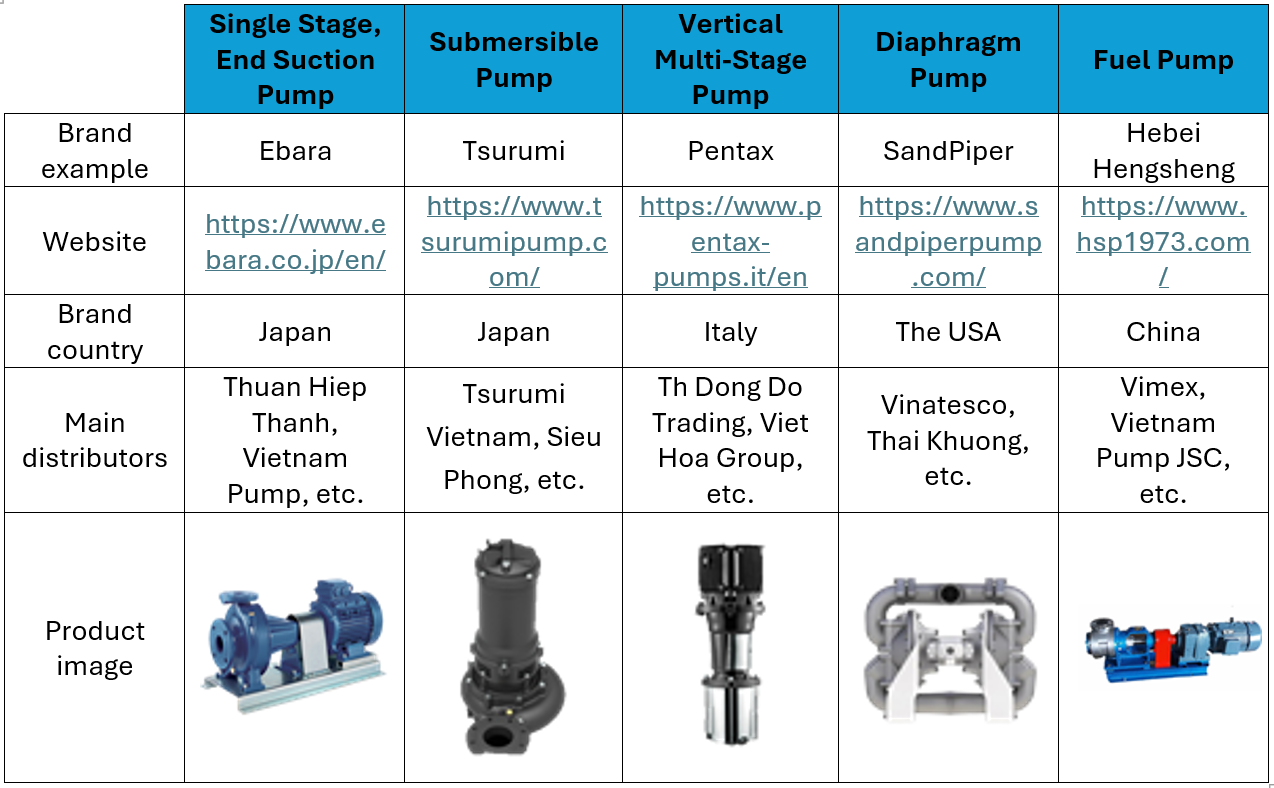

Global giants such as Ebara or Tsurumi dominated the market, offering high quality pumps of various types for different uses, at a reasonable price. Centrifugal pumps are the most common types in Vietnam market, namely: Single Stage, End Suction Pump, Submersible Pump and Vertical Multi-Stage Pump. Other pumps such as: Diaphragm Pump and Fuel Pump are also frequently used by factories or power plants.

Some common pump brands in the Vietnam market

Source: B&Company Complication

Prospect for Foreign Investors in Vietnam Pumps Market

The pumps market in Vietnam is forecast to continue to grow at about 9% in the period 2022-2032[4]. This growth is largely attributed to the increasing demand for efficient fluid management solutions across industries such as water and wastewater treatment, industrial development, construction and urbanization. Moreover, the demand for energy development increases as the government underscored the urgent need to transition to cleaner and safer energy sources, state in 7th Central Committee Conference in 2019[5].

Opportunities for pumps to growth

| Sector | Growth driver |

| Industrial development, construction and urbanization | · The urbanization rate in Vietnam has increased rapidly from 36% in 2015 to 42% in 2023, and is expected to reach over 50% by 2030

· The proportion of the industry and construction sector has increased from 34% in 2015 to 37% in 2023 · Increasing the need for efficient water supply, wastewater management, and fluid handling systems |

| Wastewater and environmental treatment | • By 2030, 100% of urban areas of grade IV and above, industrial parks, export processing zones, and industrial cluster will have centralized wastewater treatment systems that meet environmental technical standards.

· Increasing the needs for industrial pumps especially the submersible wastewater pump segment in the near future |

| Energy development | · By 2030, the total power capacity in Vietnam will reach 150 GW, an increased about 2 times when comparing with the number of 80 GW in 2023

· Raising demand for industrial pumps since it is essential in power generation processes, including cooling systems, fluid circulation, and wastewater management in energy infrastructure. |

Source: B&Company Complication

Conclusion

Vietnam’s pumps market presents significant growth opportunities, driven by rapid urbanization, industrial expansion, and rising demand for efficient water, wastewater, and energy management systems. Government initiatives and policies further support this growth trajectory by prioritizing infrastructure development and environmental sustainability. However, foreign investors must navigate challenges like regulatory complexities, local competition, and the need for eco-friendly, cost-effective solutions. With strategic planning and adaptability, stakeholders can capitalize on Vietnam’s dynamic market and contribute to its sustainable industrial progress.

[1]International Trade Center (2024). Import Value of Pump in Vietnam from 2013 to 2023 <Access>

[2] Statista (2024). Vietnam Urbanization Rate <Access>

[3] Trading Economics (2024). Vietnam Industrial Production <Access>

[4] Sper Market Research (2022). Vietnam Pump Market and Prospect to 2032 <Access>

[5] Politburo of the Communist Party of Vietnam (2019). Strengthening Resource Management and Environmental Protection <Assess>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |