2025年12月24日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

2022年に観光が全面再開されて以来、ベトナムの観光産業は力強く回復し、経済成長の明るい兆しとなっています。2025年の最初の11か月間のベトナムへの外国人旅行者数は、パンデミック前の記録を上回り、1,910万人を超え、2024年の同時期と比較して前年比2,091億3千万トン増加しました。[1]ベトナムの観光部門は、社会経済開発計画における経済の柱としての地位を強化する新たな機会に直面しています。旅行需要の急増を背景に、ベトナムは地域有数の旅行先として台頭しており、外国投資家にとって多くの魅力的な投資機会を生み出しています。

2025年のベトナム観光:パンデミック後の回復から力強い成長へ

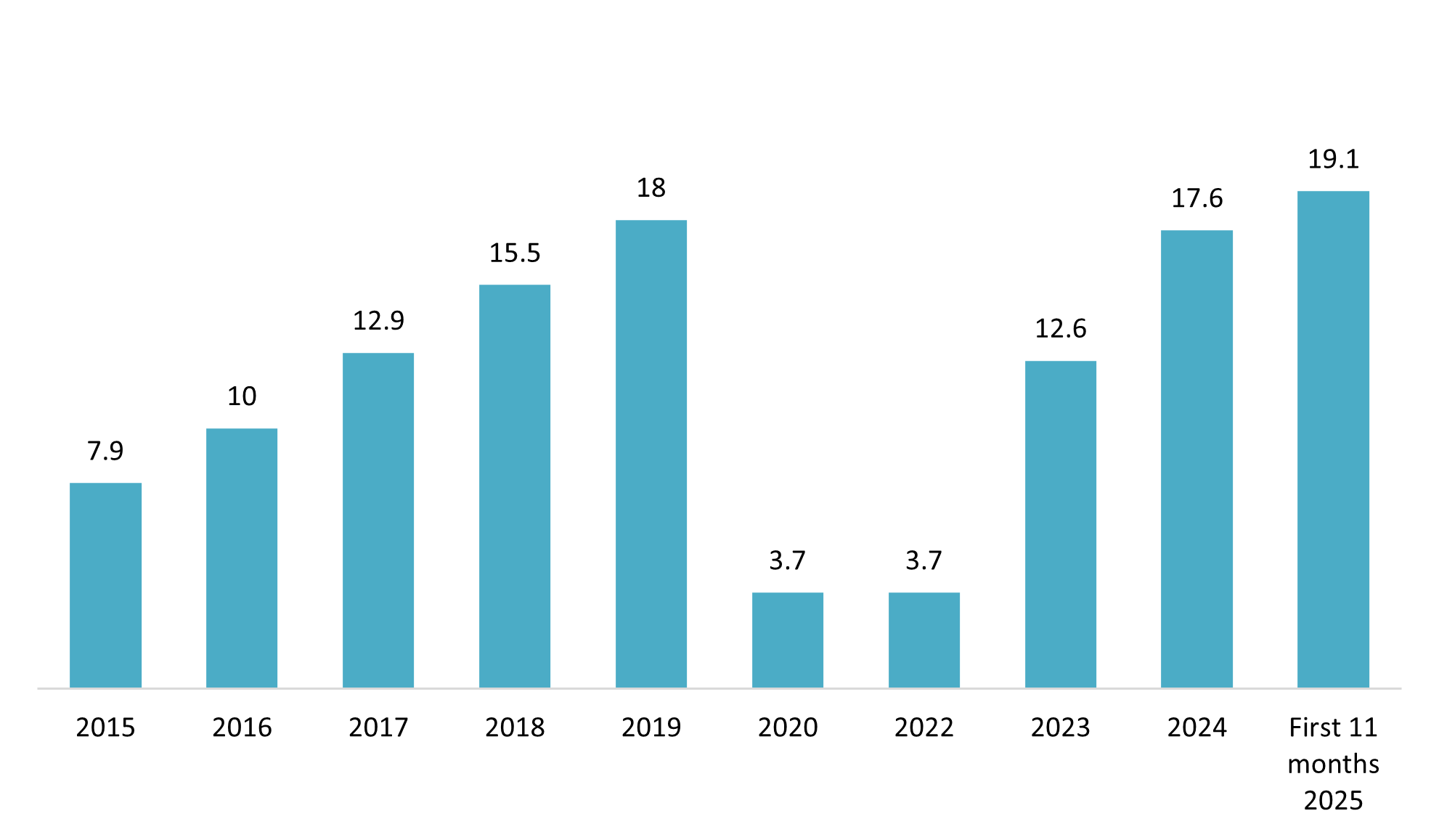

2015年から2019年にかけて、ベトナムの観光セクターは国際観光客数が790万人から1,800万人へと着実に成長しました。その後、2020年から2022年にかけてパンデミックの影響で急激に減少し、観光客数は約370万人にまで落ち込みました。2023年以降、市場は明確な回復を見せ、2024年も引き続き力強い成長を遂げました。

Number of international visitor arrivals to Vietnam (2015 – 2025)

単位:百万人の訪問者

出典:Vconnex ベトナム国家観光局

ベトナムの観光部門は、2025年に2,200万~2,300万人の海外からの観光客を迎え、1億2,000万~1億3,000万人の国内旅行者を受け入れ、観光収入総額を約980兆~1,050兆ドンに増やし、1,000兆ドンという目標を設定した。[2]特に、2025年の最初の11か月間で、国際観光客到着数は1,910万人に達し、パンデミック前のピークであった2019年を上回り、非常に力強い回復の勢いを反映し、目標の83%~87%を達成しました。

財務省統計総局によると、2025年の最初の11か月間の宿泊・飲食サービス収入は767兆ドンと推定され、2024年の同時期と比較して前年同期比14.61兆ドン増加しました。一方、同時期の旅行サービス収入は85.4兆ドンと推定され、前年同期比19.91兆ドン増加しており、旅行需要の回復と拡大が引き続き強まっていることを示しています。この成長傾向は、ハノイ、ホーチミン市、ダナン、クアンニン、ヴィンロンなどの主要都市や主要観光地で特に顕著であり、国内外の観光市場の活況を浮き彫りにしています。[3].

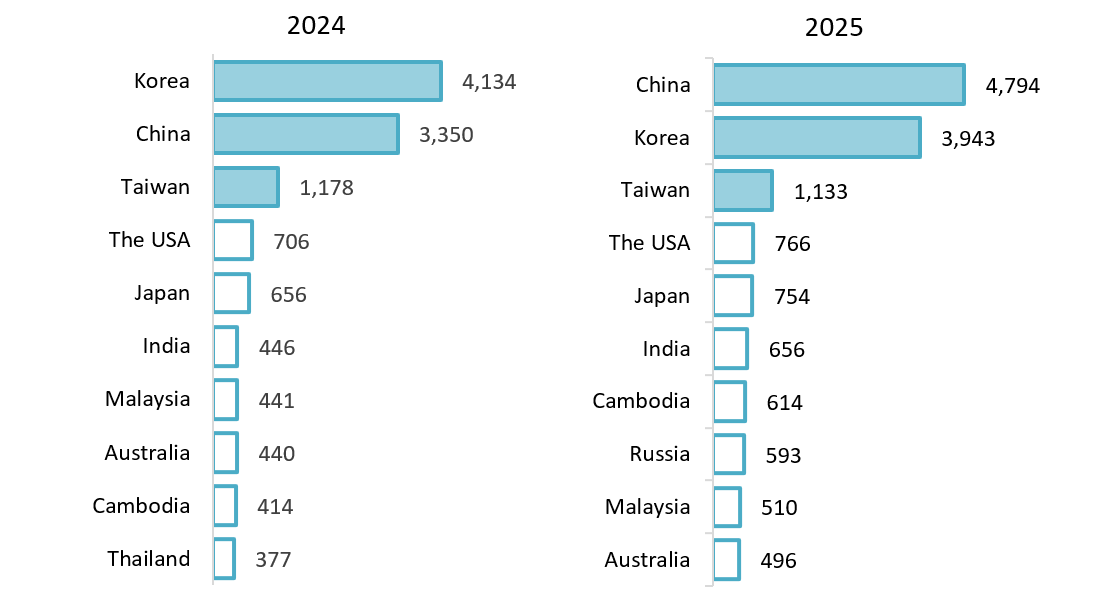

2024年の同時期と比較して、2025年の最初の11か月間にベトナムへの訪問者数が最も多かった上位10の送客市場

単位:千人

出典:Vconnex ベトナム国家観光局

2025年の最初の11ヶ月間、中国は引き続きベトナムへの訪問者の最大の送客市場であり、2024年の同時期と比較して力強い成長を記録しました。日本と米国は堅調な成長を維持しましたが、韓国市場はわずかに減少しました。カンボジアやマレーシアなど東南アジアの近隣市場も力強い増加を記録し、インドも堅調な成長を見せました。ヨーロッパ市場は引き続き拡大し、ベトナムのビザ免除政策の有効性を浮き彫りにしました。特にロシアからの訪問者数は59万3千人で、前年比190.9%増加し、ロシアがベトナムにとって最大のヨーロッパ送客市場であり、地域で最も急速に成長している市場であることを改めて証明しました。

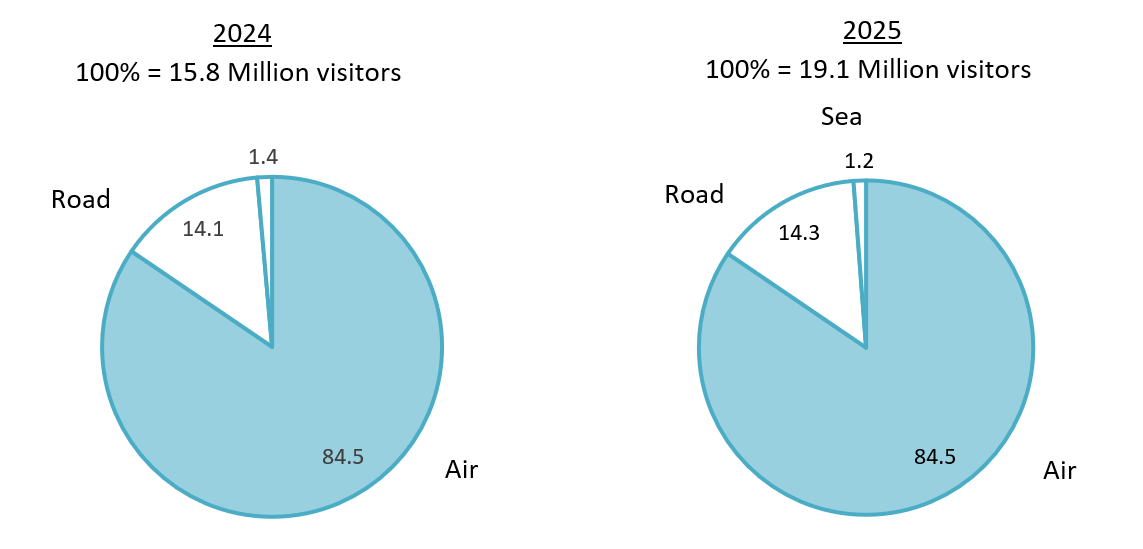

2025年の最初の11か月間にベトナムを訪れた外国人旅行者が利用した交通手段の種類(2024年の同時期と比較)

出典:Vconnex ベトナム国家観光局

両比較期間において、ベトナムを訪れる外国人旅行者にとって航空旅行は依然として主要な移動手段であり、これは国際観光客の増加が航空輸送能力と航空路線の接続に大きく依存していることを反映しています。道路は、近隣市場からの観光客や国境ゲートを通過する観光客の流れと関連して、重要な補助的なチャネルとしての役割を担っていますが、その割合は概ね安定しています。一方、海路は依然として非常に小さな割合を占めており、航空や道路と比較して、クルーズまたはクルーズセグメントにおけるスペースがまだ限られているか、十分に活用されていないことを示しています。

2025年のベトナムの観光産業の成長原動力:ビザ政策の開放、観光振興の強化、観光インフラの拡大

ベトナムの観光業の好調を牽引する要因は数多くあります。特に、2025年3月7日付の政府決議第44/NQ-CP号に基づき、ドイツ、フランス、イタリア、スペイン、イギリス、ロシア、日本、大韓民国、デンマーク、スウェーデン、ノルウェー、フィンランド、ポーランド、チェコ共和国、スイスの国民は、ベトナム入国時にビザ免除の対象となります。柔軟なビザ政策は、観光地の魅力を高め、ベトナムが地域諸国との競争力を高めるための重要な手段です。これは、ベトナムのおもてなしの精神と世界への開放性を反映した、前向きなシグナルです。[4]さらに、航空部門は急速に回復し、ベトナムとヨーロッパ、アメリカ、インド、オーストラリアなどを結ぶ多くの新しい直行便が再開・開設され、国際的な観光客の流れが促進されました。[5].

国内外における観光プロモーションとマーケティング活動の強化も、この分野の成長を牽引する重要な要因の一つとなっています。11月には、ベトナム観光局が米国、中国、オーストラリアでプロモーションプログラムを実施し、WTMロンドン2025に参加しました。

「ベトナム:経験の世界、特別な価値」をテーマに米国でベトナム観光促進プログラムを実施。

出典:Vconnex ベトナム国家観光局

デジタルコミュニケーション、新製品開発研究、地域連携が協調的に実施され、特に北米とヨーロッパの長距離市場におけるベトナムの観光ブランドの認知度向上に貢献しました。2025年11月の到着者数は前月比50%以上増加しました。さらに、ベトナムの観光インフラは拡大を続けています。2025年11月20日現在、国内には5つ星の宿泊施設が289軒(94,599室)、4つ星の宿泊施設が345軒(47,536室)あります。[6]

ベトナムの観光市場における主要な新興トレンド

– グリーンツーリズムと持続可能性の目標: エコツーリズムとグリーントラベルが注目を集めています。フォンニャ・ケバン、カティエン、コンダオといった主要なエコデスティネーションでは、20%以上の訪問者数増加を記録しました。宿泊施設では、3つ星以上の宿泊施設約70%が省エネ対策やプラスチック廃棄物削減の取り組みを実施しています。注目すべき例としては、「プラスチック廃棄物ゼロ都市」プロジェクトを推進するホイアンや、「グリーンで持続可能な観光」を掲げるダラットなどが挙げられます。[7].

– 観光業界におけるAIの応用: オンラインプラットフォームでは、宿泊施設、旅程、サービスのパーソナライズにAIを活用するケースが増えています。この傾向は、検索、予約、旅程作成、決済、旅行中のサポートなど、旅行のコンバージョン率向上と「オールインワン」の旅行体験の最適化に役立ち、特に若い旅行者に魅力的です。例えば、Booking.comはAIトリッププランナーとGenAI機能を宿泊施設の検索・選択プロセスに統合し、旅行者が選択肢を比較検討し、ニーズに最適な宿泊施設を簡単に選べるようにしています。[8].

– 観光におけるデジタル変革: ベトナムでは、観光事業もデジタル変革を加速させており、エンドツーエンドの業務をデジタル化し、デジタル決済を統合することでコストを削減しながら顧客体験を向上させています。例えば、ヴァンミエウ文化科学活動センターは、電子チケット、QRベースの遺物検索、デジタル化されたデータベース、3Dマッピングを導入し、現地での訪問者の体験を向上させています。[9]一方、一部のホテルグループは独自のアプリを開発しており、例えばVinpearlは予約、支払い、アプリ内チェックイン/チェックアウトを可能にし、さらにロイヤルティポイントや旅程管理を統合することで、よりシームレスなエンドツーエンドの滞在を実現しています。[10].

Tourists experience green tourism in Ninh Binh

出典:Vconnex ハノイ

2025年の観光事業ライセンスに関する最新情報

| いいえ | コンテンツ | 2024年9月現在 | 2025年9月現在 | 2025年11月更新 | 備考 |

| 1 | 国際旅行サービスのライセンス | – 2024年9月25日現在、ベトナムには全国で4,144社の国際旅行会社があり、そのうち株式会社は1,265社、外資系企業は38社、有限責任会社は2,836社、民間企業は5社となっている。

2024年の最初の9か月間で、ベトナム観光局は国際旅行サービスライセンス申請928件を審査しました。このうち、新規ライセンスは346件、更新ライセンスは317件、再発行ライセンスは2件、取り消しライセンスは263件でした。

|

– 2025年9月16日現在、ベトナムには全国で4,385社の国際旅行会社があり、そのうち株式会社は1,330社、有限責任会社は3,049社、民間企業は6社となっている。

– 2025年8月16日から2025年9月16日までの間に、ベトナム観光局は、旅行業者から提出された96件の行政手続きを審査しました。これには、新規ライセンスの発行43件、ライセンスの更新37件、国際旅行サービスライセンスの取り消し16件が含まれます。

|

– 2025年11月18日現在、ベトナムには全国で4,437社の国際旅行会社があり、そのうち株式会社は1,332社、有限責任会社は3,099社、民間企業は6社となっている。

– 2025年10月17日から2025年11月18日までの間に、ベトナム国家観光局は、新規ライセンス54件の発行、ライセンスの更新40件、ライセンスの再発行2件、国際旅行サービスライセンスの取り消し29件を含む、125件の行政手続きを審査・処理しました。

|

– 国際的な旅行会社の数は着実に増加し続けています。

– ライセンスは依然として明確に選択的であり、取り消されたライセンスは2024年に顕著な割合を占め、2025年の報告期間全体で増加しており、ツアーオペレーターのサービス品質、財務能力、規制遵守に対する監視が強化されることを示唆しています。 – 企業がインバウンド観光やアウトバウンド観光を合法的に運営するには国際旅行サービスライセンスが必須であり、観光産業の全体的な状況を評価するための重要な指標となります。 |

| 2 | 観光ガイドカードの発行 | – 2024年9月25日現在、ベトナムは38,979枚の観光ガイドカードを発行しており、そのうち22,767枚は国際用、14,167枚は国内用、2,045枚は現地で発行されている。

– 22,767枚の国際観光ガイドカードの主な言語は、英語(12,585枚)、中国語(6,132枚)、フランス語(1,269枚)、韓国語(1,185枚)、日本語(740枚)、ロシア語(418枚)、ドイツ語(358枚)、タイ語(347枚)、スペイン語(297枚)、イタリア語(147枚)で、残りはその他の言語でした。

|

– 2025年9月16日現在、ベトナムには42,928枚の有効なツアーガイドカードがあり、そのうち25,522枚は国際用、15,232枚は国内用、2,174枚は現地用です。

– 25,522人の国際ツアーガイドの主な言語は、英語(13,921人)、中国語(6,460人)、フランス語(1,402人)、韓国語(1,335人)、日本語(705人)、ロシア語(409人)、ドイツ語(352人)、タイ語(331人)、スペイン語(315人)で、残りはその他の言語でした。

|

– 2025年11月18日現在、ベトナムには44,171枚の有効なツアーガイドカードがあり、そのうち26,309枚は国際用、15,641枚は国内用、2,221枚は現地用です。

– 26,309人の国際ツアーガイドの主な言語は、英語(14,422人)、中国語(6,625人)、フランス語(1,453人)、韓国語(1,364人)、日本語(719人)、ロシア語(417人)、ドイツ語(356人)、タイ語(331人)、スペイン語(322人)、イタリア語(202人)で、残りはその他の言語でした。

|

-観光ガイドカードの数は、観光労働力の回復と拡大を反映して、時間の経過とともに着実に増加しています。

– 国際ツアーガイドの成長が最も速く、訪日観光客へのサービスに対する需要の大幅な増加を示しています。 – 言語構成は比較的安定しており、英語と中国語が優勢です。韓国語、日本語、フランス語、ロシア語の増加は、主要なソース市場からの需要の多様化が進んでいることを示しています。

|

| 3 | 4つ星から5つ星の観光宿泊施設の星評価分類 | 2024年9月26日現在、ベトナムには、客室数87,328室の5つ星観光宿泊施設が269軒、客室数51,670室の4つ星ホテルが376軒ありました。 | 2025年9月19日現在、ベトナムには93,058室を有する5つ星観光宿泊施設が282軒、46,713室を有する4つ星ホテルが339軒ありました。 | 2025年11月20日現在、ベトナムには94,599室を有する5つ星観光宿泊施設が289軒、47,536室を有する4つ星観光宿泊施設が345軒ありました。 | – 高級宿泊施設の供給は拡大を続けており、特に5つ星ホテルでは施設数が増加し、客室収容能力が高まっています。

一方、4つ星セグメントではわずかな変動が見られ、中上級ホテル層内での再編または再分類が行われていることが示唆されます。

|

出典: B&Companyによる 観光速報 09/2024、 観光速報 2025年9月 や 観光速報 2025年11月

外国人投資家への影響

ベトナムの観光セクターは、国際需要の回復と政策および市場の好調な追い風を受け、新たな成長サイクルに入りつつあります。主要な要因としては、欧州主要国および重点市場へのビザ免除、長距離直行便の復活・就航などが挙げられ、これにより、より多く、より長期滞在の観光客の流入が促進されています。同時に、グリーンツーリズムとデジタル旅行の明確な勢いは、より付加価値の高い、エンドツーエンドの観光サービス提供の余地を生み出しています。

しかし、このセクターは顕著な課題に直面しています。国際的な成長は依然として航空旅行に大きく依存しており、航空運賃の変動や路線の接続状況に左右されます。一方、海上旅行のシェアは依然として非常に小さく、クルーズ船の潜在的可能性は未開拓です。さらに、ベトナムを訪れる国際観光客はより幅広い国から増加しており、それぞれの訪問者セグメントに合わせたよりきめ細やかな戦略が求められています。また、多数の国際旅行会社の存在や、ライセンスの頻繁な取得・取消も、競争の激化とコンプライアンス要件の厳格化を示唆しています。

外国人投資家への推奨事項

– 「量より価値」を優先する: 収益の最大化を目指し、急成長を遂げるソースマーケット(北東アジア、インド、ヨーロッパ、ロシア)をターゲットに、高級レジャー、テーマ別体験、プレミアムモビリティ体験、長期滞在型商品に注力します。鉄道旅行においても同様のプレミアム化の傾向が見られ、ベトナム国鉄は2025年5月にハノイ・ハイフォン路線に新たな「ラグジュアリー」車両を導入しました。[11].

– 環境に優しく持続可能な基準に基づいたプロジェクトを設計する: エネルギー効率やエコ体験を重視し、市場のトレンドに合致し、持続可能性を重視する旅行者を惹きつけるために、認定認証の取得を目指します。特に、プレミア・ビレッジ・ダナン・リゾートは、環境への責任と持続可能な運営において高い基準を満たす観光施設に与えられる、世界的に認められたエコラベルであるグリーンキー認証の最新の国際認証を取得しました。[12].

– デジタル観光インフラへの投資: Booking.com などの旅行サービス プラットフォームとの統合や、社内旅行アプリ (Vinpearl スタイルのモデルなど) の開発によってデジタル ツーリズム インフラストラクチャに投資し、顧客体験を最適化します。同時に、大手の旅行コンテンツ クリエイターと提携してブランド リーチを拡大し、新しい顧客セグメントを獲得します。

– 飛行機旅行への過度な依存を減らす: 道路、鉄道、海路、航空といった多様な交通手段の接続性が高い目的地を優先し、近隣市場からの陸路旅行者向けにカスタマイズされた商品を開発し、地域連携モデルを活用して滞在期間を延長する。ベトナムの明確な例としては、クアンニン省がモンカイ国際国境ゲートを経由して中国から陸路で訪れる旅行者向けにカスタマイズされた商品を開発し、約1,000人の陸路旅行グループを歓迎し、クアンニン省で4泊5日の旅程を実施した。[13].

*ご注意: 本記事の情報を引用される場合は、著作権の尊重のために、出典と記事のリンクを明記していただきますようお願いいたします。

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |

[1] ベトナムの観光が急増、海外からの観光客が1900万人以上

[2] ベトナムの観光業は2025年の最初の6か月で力強い成長を記録し、2025年の年間目標の達成を目指している。

[3] ベトナムの観光が急増、海外からの観光客が1900万人以上

[4] ビザ免除はベトナムの観光成長の大きな後押しとなる

[5] デジタルとグリーンの変革:持続可能な観光開発への「黄金の鍵」

[6] ベトナム観光情報 – 2025年11月 (PDF)

[7] 持続可能な開発に向けたグリーンツーリズムを推進するトレンド

[8] Booking.com、AIを活用した新機能で旅行計画を強化 ― より簡単でスマートな意思決定を実現

[9] デジタル変革の旅を続けるベトナム観光:データを繋ぎ、文化を広める

[10] Vinpearlアプリ:登録ガイド

[11] ハノイ・ハイフォン鉄道に新たな豪華車両が登場

[12] Premier-village-danang.com。グリーン認証:グリーンキー

[13] 中国からの高級観光客の流入促進