17Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Market overview of the Vietnam cosmetics industry

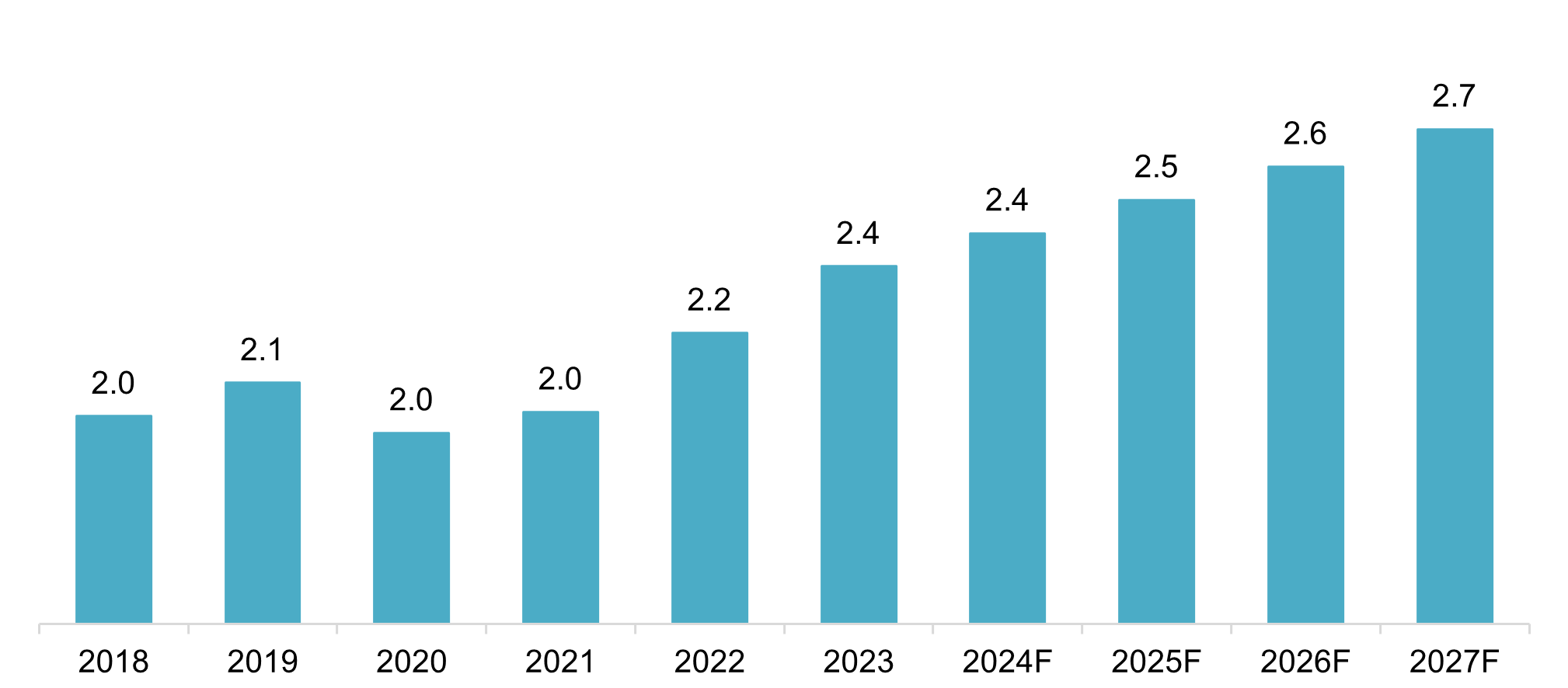

Vietnam’s cosmetics market is emerging as one of the most dynamic and fastest-growing in Southeast Asia. However, growth is not only measured in terms of market size, but also through clear shifts in consumer awareness and preferences. Currently, Vietnam’s cosmetics market is valued at approximately $2.5 billion and is expected to continue its strong growth trajectory, reaching an estimated $2.7 billion by 2027.

Vietnam Cosmetics Market Size

Unit: USD Billion

Sources: Statista

The market is driven by several key factors:

– A Growing Middle Class: Vietnam is experiencing a demographic golden age, with the middle class currently accounting for 13% of the population and projected to reach 26% by 2026[1]. This group has rising incomes and is increasingly willing to spend on high-quality products.

– The Influence of Social Media and Digital Platforms: The growth of social media and e-commerce platforms, such as TikTok Shop and Shopee Mall, has driven new consumer trends and increased awareness of health and beauty products. These platforms influence purchasing decisions, especially among the younger generation and emerging middle class, through flash sales, influencer content, and live demonstrations. Brands must invest in digital marketing, influencer partnerships, and e-commerce campaigns, adapting quickly to shifting trends.

– Greater Awareness of Health and Beauty: Following the COVID-19 pandemic, Vietnamese consumers have become more conscious not only of their physical health but also of personal appearance and self-care. This change in mindset has fueled growing demand for skincare and wellness-oriented beauty products, particularly those designed to address specific skin concerns and support long-term skin health.

– A Strong Demographic Advantage: According to the General Statistics Office, women accounted for 50.1% of Vietnam’s 100.3 million population in 2023[2], while those aged 15 to 59 made up 62.2%[3], representing a strong demographic driver of demand for beauty products.

Imported Cosmetics Products: Popular Types and Consumer Demand

Vietnam’s cosmetics market is marked by diversity in both product segments and price points, catering to a wide range of consumer needs.

| Type | Description |

| Skincare | · Leading growth driver and the most widely used segment, with over 60% of consumers applying skincare products daily.

· A 2023 Statista survey of Vietnamese consumers aged 18 and older found that the most commonly used personal care products included facial cleansers (49.1%), colognes and perfumes (41.2%), antiperspirants (31.8%), sunscreens (31.4%), moisturizers (25%), facial creams (20.9%), and facial masks (19.5%)[4]. · Another notable trend is the strong shift toward organic, natural, and vegan products, creating opportunities for new entrants. · Demand for anti-aging products is also rising, driven by an aging population and increased health and beauty awareness. In addition, gender-neutral cosmetics are gaining traction globally. Although specific data for Vietnam is not yet available, this is a highly promising segment that reflects a shift in men’s perception of beauty |

| Hair care products | · Seeing robust growth, particularly those with targeted treatment features.

· Consumers are increasingly seeking natural, herbal-based products (e.g., soapberry, pomelo peel, ginger) and avoiding chemicals such as sulfates and parabens. · Products addressing specific concerns like hair loss, dandruff, and damage repair are in high demand. Popular product types include shampoo, conditioner, and intensive care treatments like hair serums, oils, and masks. |

| Makeup | · One of the most dynamic and fast-growing segments, driven by Gen Z and Millennials, as well as social media influence.

· The market is dominated by the natural and lightweight K-beauty makeup style with a “glass skin” look. Given Vietnam’s humid climate, products with long-lasting, oil-controlling, and waterproof properties are preferred. Top choices include sunscreen (often used as a primer), cushion foundations, matte liquid lipsticks, and glossy lip tints. |

In overall, the Vietnamese cosmetics market is witnessing a shift in consumer focus from superficial beauty toward foundational skincare and specific problem-solving products. The growing preference for oil-controlling sunscreens and skin-repair serums indicates that consumers are becoming more knowledgeable and have more specialized skincare needs (e.g., oily or sensitive skin, post-damage recovery).

The market is expanding not only in size but also in sophistication, demanding advanced scientific formulations, targeted solutions, and personalized products. This evolution presents a major opportunity for Japanese brands, which are globally recognized for their product innovation, research, and advanced formulation technologies. Anti-aging products (aligned with demographic trends) and skincare solutions adapted to Vietnam’s tropical climate offer particularly strong potential.

How B&Company Can Support Japanese Cosmetic Brands Entering the Vietnamese Market

| Service | Description |

| In-depth Market Research | · Consumer Surveys: Understand Vietnamese consumers’ behaviors, preferences, and awareness of local and international cosmetic brands.

· Competitive Analysis: Provide insights on key players, distribution channels, pricing strategies, and marketing activities. · Market Segmentation: Identify high-potential segments by age, income, and region (e.g., natural cosmetics, sensitive-skin products, premium cosmetics). |

| Market Entry Strategy Consulting | · STP Strategy (Segmentation – Targeting – Positioning): Advise on product positioning and how to align with local preferences.

· 4P Strategy (Product – Price – Place – Promotion): Recommend product development, pricing models, distribution channels (offline/online), and marketing strategies tailored to Vietnam. |

| Partner Matching and Investment Support | · Find Distributors and Retail Partners: Identify suitable distribution, retail, and e-commerce partners.

· Regulatory Support: Assist in liaising with regulatory agencies and obtaining product registration licenses from the Vietnamese Ministry of Health. · Legal & Tax Consulting: Advise on legal frameworks, tax issues, and foreign investment procedures. |

| Product Testing and Pilot Launches | · Product Testing: Collect real-world feedback from Vietnamese consumers prior to market launch.

· Pilot Launches: Support small-scale rollouts in major cities such as Hanoi, Ho Chi Minh City, and Da Nang. |

[1] https://vneconomy.vn/viet-nam-se-co-26-dan-so-thuoc-tang-lop-trung-luu-vao-nam-2026.htm

[2] https://en.baochinhphu.vn/viet-nams-population-exceeds-100-million-mark-111240102154853925.htm

[3] https://www.ijeijournal.com/papers/Vol13-Issue8/13086265.pdf

[4] International Trade Administration: https://www.trade.gov/market-intelligence/vietnam-beauty-and-personal-care-products

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |