03Feb2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s wood products industry has long been a pillar of the country’s export-oriented economy, maintaining its position as a leading global supplier. In 2024, this sector continues to showcase remarkable growth, despite challenges in the global market. This article delves into key aspects of the wood products market in Vietnam, including timber output, trade performance, current trends, major players, and prospects.

Wood production in Vietnam and the trend of sustainable forest management

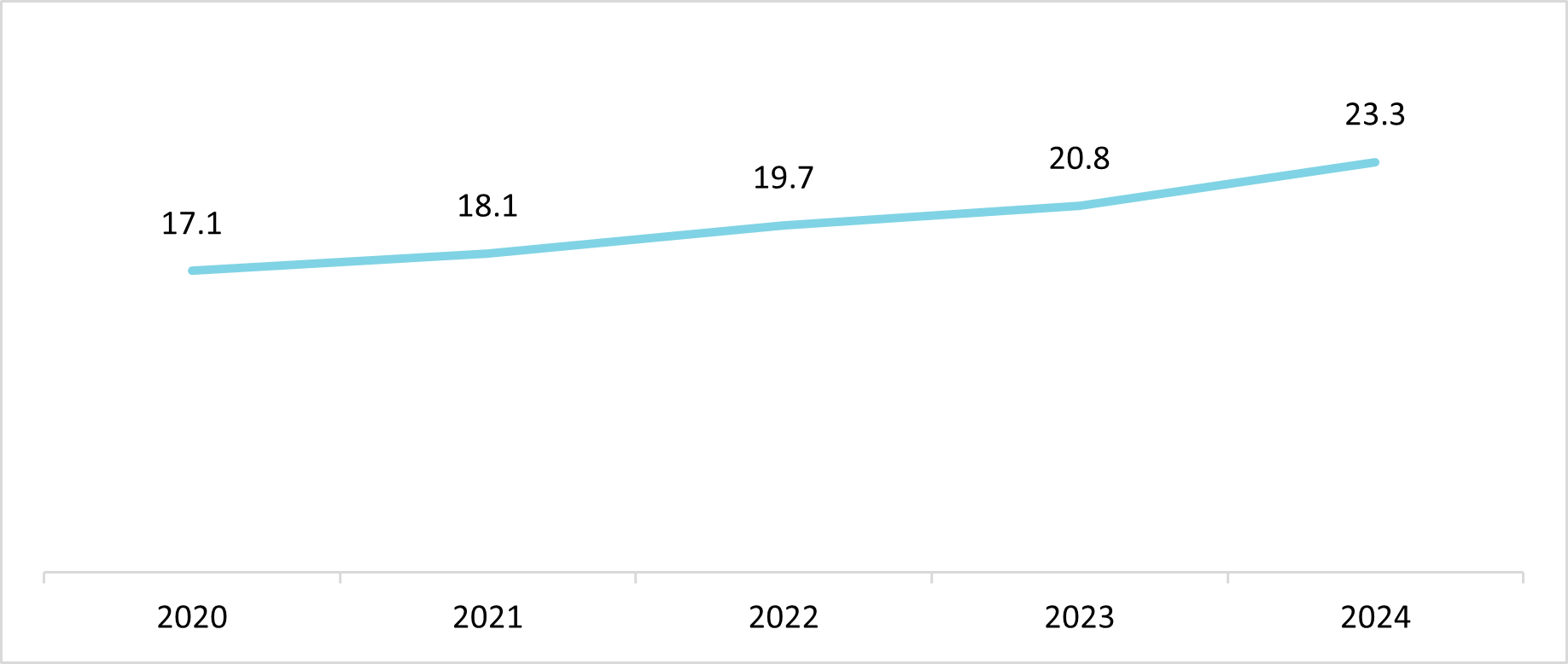

Wood production in Vietnam in 2024 was estimated to reach approximately 23.3 million cubic meters, up from 20.8 million cubic meters in 2023. This growth reflects the country’s continuous investment in forestry and expanding plantation areas.

The wood output from 2020 to 2024[1]

Unit: million cubic meters

Source: GSO, Vneconomy

A significant portion of the timber harvested in Vietnam comes from plantation forests, which account for over 80% of the total output. The shift towards plantation forestry has been a deliberate strategy aimed at reducing pressure on natural forests while meeting the rising demand for raw materials. The government’s afforestation programs and incentives for private sector participation have contributed significantly to this outcome.

One of the most prominent trends in Vietnam’s wood industry is the focus on sustainable forest management and the use of certified wood. As global consumers increasingly demand environmentally responsible products, Vietnamese manufacturers are adopting international standards such as the Forest Stewardship Council (FSC) certification. By 2024, over 1 million hectares of forests in Vietnam will be FSC-certified, reflecting the country’s commitment to sustainable practices.

Another trend is the rising adoption of technology in wood processing and manufacturing. Many companies are investing in advanced machinery and automation to improve efficiency, reduce waste, and meet the stringent quality requirements of export markets. Additionally, the shift towards high-value-added products, such as custom-designed furniture, has gained momentum as manufacturers seek to enhance their competitiveness.

Wood Export Turnover in Vietnam recorded $17.2 billion

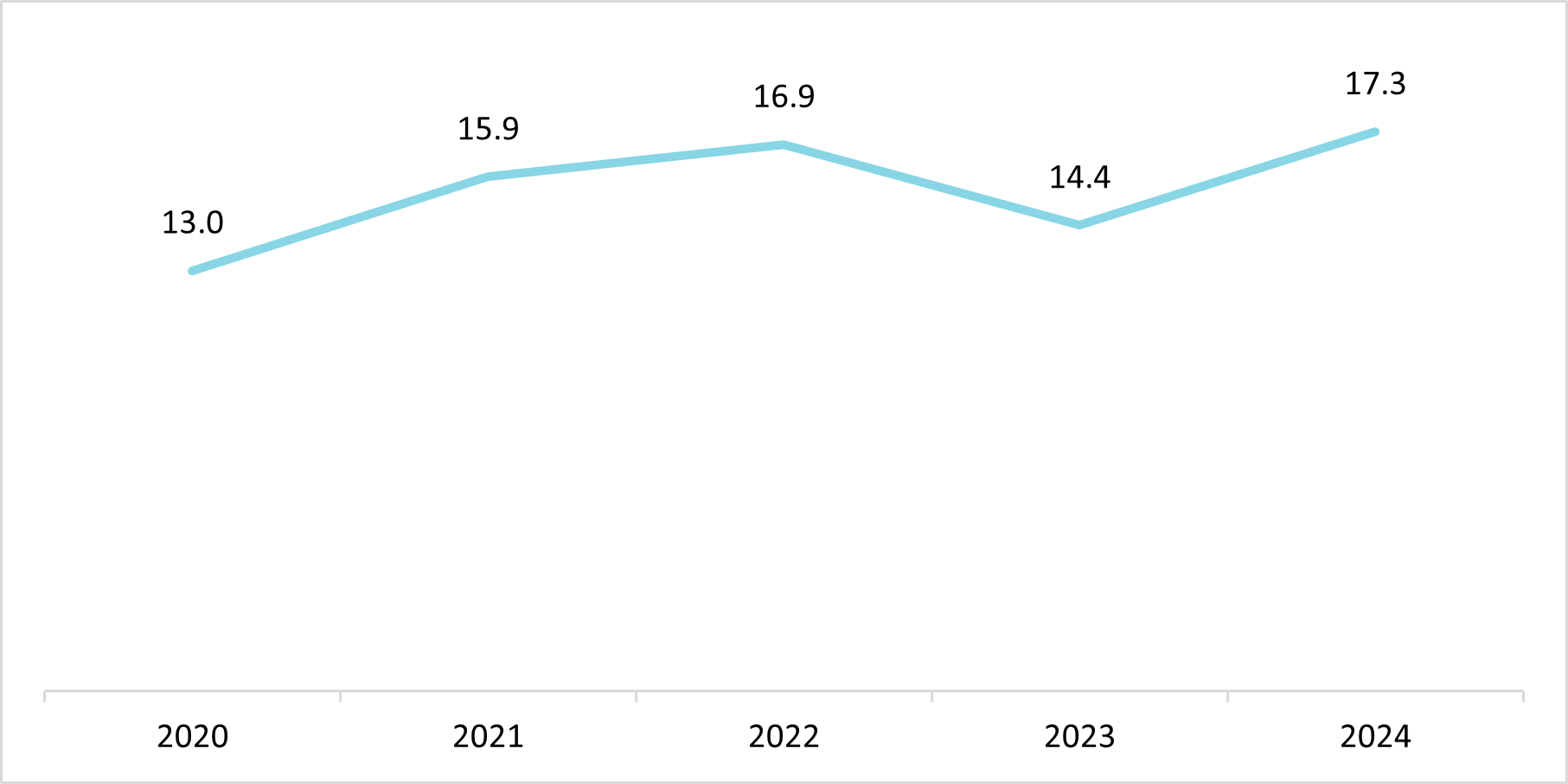

In 2024, the export turnover reached a record $17.3 billion, with wood and wood products accounting for approximately $16.3 billion, and non-wood forest products making up the remaining $1 billion. Wooden furniture continues to dominate Vietnam’s wood product exports, accounting for over 60% of the total export turnover.

Vietnam’s wood industry has export from 2020 to 2024[2]

Unit: billion USD

Source: GSO, Vneconomy, VCCI

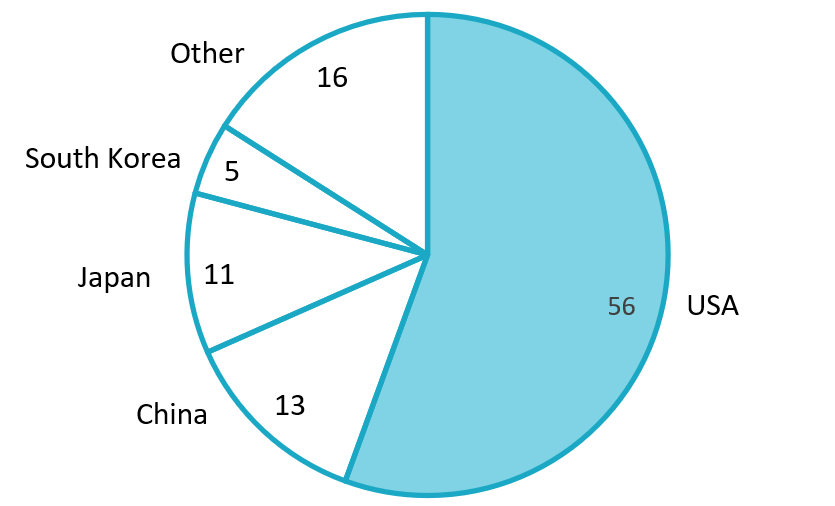

This growth has been driven by high demand in key markets such as the United States, China, Japan, and South Korea. The United States remains the largest market, driven by high demand for furniture and home goods. China plays a key role as both a market and a processing hub for Vietnamese wood products. Japan and South Korea continue to grow as significant markets, especially for sustainable wood and biomass fuels like wood pellets, driven by their environmental policies and focus on renewable energy. Besides that, the European Union has seen a notable uptick in demand, driven by the EU-Vietnam Free Trade Agreement (EVFTA), which has reduced tariffs on Vietnamese wood products.

Main export market in the first 9 months of 2024

100%= 11.7 billion USD

Source: VCCI [3]

Vietnam’s wood exports are evolving with key trends: a focus on sustainable, FSC-certified products to meet global eco-friendly demands; growing exports of wood pellets and chips as renewable biomass fuels, especially to Japan and South Korea; and the rise of carbon credit initiatives tied to forest management, opening new revenue streams through carbon trading.

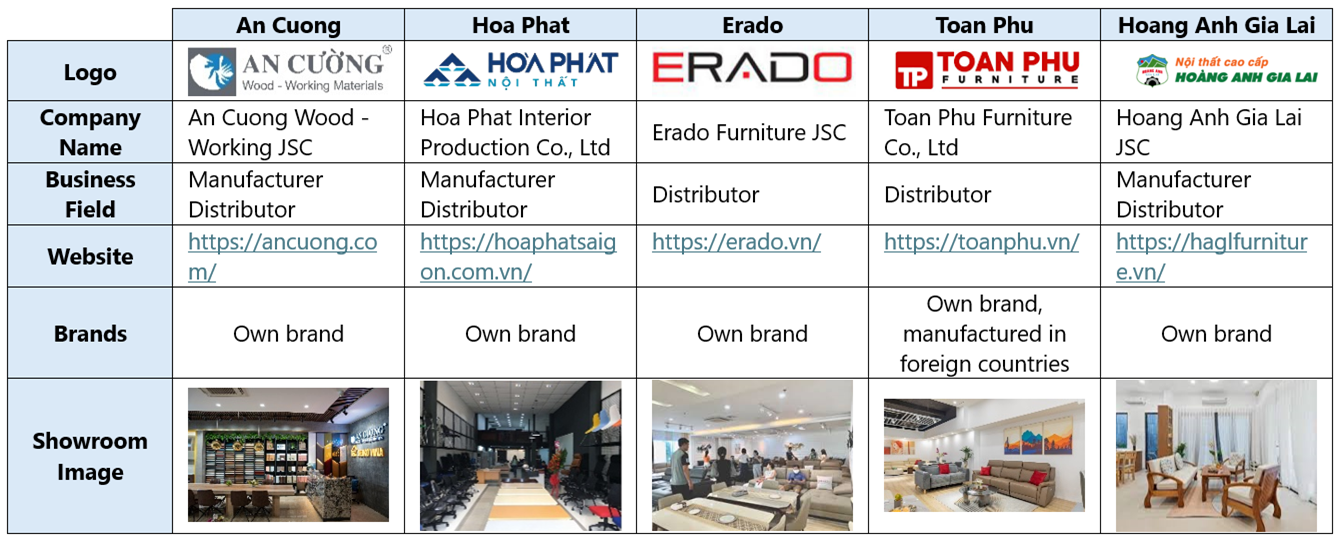

Main Players in the Wooden Furniture Manufacturing and Export Market

The furniture industry in Vietnam features a diverse range of companies, including large domestic manufacturers, joint ventures, and foreign enterprises. The table below shows some of the top furniture manufacturers/distributors in Vietnam.

Global furniture giants like IKEA and Ashley Furniture have also played an influential role in Vietnam’s furniture market. These companies do not operate directly in the country but source extensively from Vietnamese suppliers. This collaboration has introduced advanced production standards and provided local manufacturers with valuable experience in meeting the demands of global buyers.

Challenges and Prospects for the Wood Industry

Despite its impressive growth, Vietnam’s wood industry faces several challenges. One major issue is the increasing scrutiny of the legality of timber sources. With stringent international regulations, such as the EU’s Deforestation Regulation, Vietnamese exporters must ensure that their products comply with these requirements. Non-compliance could lead to trade restrictions and loss of market access.

Another challenge is the rising cost of raw materials and labor. As Vietnam’s economy grows, wages have been increasing, putting pressure on profit margins. Moreover, the reliance on imported wood materials exposes the industry to fluctuations in global supply and prices.

Climate change is also a looming threat, with unpredictable weather patterns affecting timber yields and quality. Addressing these issues requires investments in climate-resilient forestry practices and technologies.

Looking ahead, the prospects for Vietnam’s wood industry remain positive. The global demand for wooden furniture and sustainable products is expected to grow, offering ample opportunities for Vietnamese manufacturers. Government support in the form of favorable policies, trade agreements, and financial incentives will further bolster the sector.

Moreover, the increasing urbanization and middle-class growth in Asia, particularly in China and India, present untapped markets for Vietnamese wood products. By diversifying their market base and focusing on innovation, Vietnamese companies can reduce reliance on traditional markets and ensure long-term sustainability.

Conclusion

In 2024, Vietnam’s wood products market will continue to thrive, driven by steady timber output, robust export performance, and adoption of sustainable practices. While challenges such as regulatory compliance and rising costs persist, the industry’s resilience and adaptability offer a promising outlook. By embracing innovation and sustainability, Vietnam is well-positioned to maintain its status as a global leader in the wood products industry.

[1] (2020) https://www.gso.gov.vn/du-lieu-va-so-lieu-thong-ke/2021/09/thao-go-kho-khan-duy-tri-san-xuat-va-tai-phuc-hoi-nganh-go

(2021) https://vneconomy.vn/nganh-lam-nghiep-dat-muc-tieu-xuat-khau-16-ty-usd-nam-2022.htm

(2022) https://vneconomy.vn/nganh-lam-nghiep-xuat-sieu-tren-14-ty-usd.htm

[2] (2020) https://www.gso.gov.vn/du-lieu-va-so-lieu-thong-ke/2021/01/nganh-go-xuat-khau-but-pha-trong-dich-covid-19/

(2021) https://vneconomy.vn/nganh-lam-nghiep-dat-muc-tieu-xuat-khau-16-ty-usd-nam-2022.htm

(2022) https://vneconomy.vn/nganh-lam-nghiep-xuat-sieu-tren-14-ty-usd.htm

(2023) https://trungtamwto.vn/chuyen-de/25696-gia-tri-xuat-khau-go-va-lam-san-dat-binh-quan-158-ty-usd

(2024) https://vneconomy.vn/xuat-khau-lam-san-lap-ky-luc-17-3-ty-usd.htm

[3] https://trungtamwto.vn/chuyen-de/27739-2-ly-do-khien-xuat-khau-go-va-san-pham-go-lo-ngai-khong-ve-dich-nhu-ky-vong

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |