This case study was consolidated in August 2020

Project Background

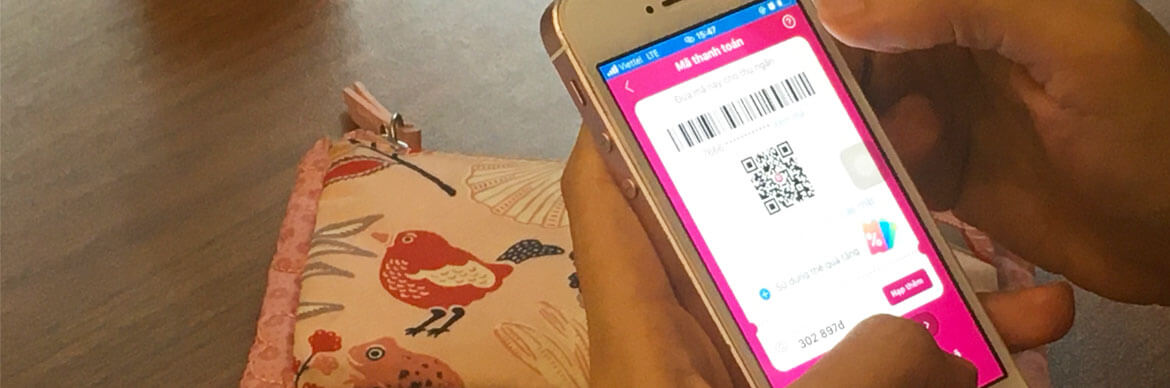

Over the past decades, the business world has witnessed dramatic changes, thanks to tremendous motivations from digital transformation waves, among which innovative payment solutions and platforms play a remarkable role in the revolution. In many countries, mobile payment services have become an increasingly crucial part of people’ daily lives. Switching rapidly from being an emerging trend to becoming a daily favourable transaction method to many, mobile payment has consequently changed the way of doing business.

In Vietnam, the high penetration rate of Internet, smartphone, young population and low finance inclusion were good premises for mobile payment. Furthermore, the mobile payment market was only in its early stage, making it a good timing to enter.

As a major group in Japan with experience investing in digital payment networks and having resource in finance, retail, ICT, our Client was able to foresee the potential and importance in this field. From that perspective, the Client and B&Company agreed to start a research project about mobile payment in Vietnam, focusing on the following objectives:

- Establish a knowledge base of this business in Vietnam and tentative strategic options from mid and long-term vision

- Evaluate the growth potential of mobile payment services in Vietnam and possible future scenarios

- Evaluate possibility for client to participate in this business and develop potential partnership